Voyager Digital, the crypto lending agency that went bust as a result of crypto contagion initiated by Three Arrow Capital’s (3AC) insolvency is at the moment preventing its chapter courtroom battle. The courtroom proceedings and monetary paperwork have proven a deep relation between the crypto lending agency and Sam Bankman Fried-owned Alameda Analysis.

Alameda is a quantitative buying and selling agency that was additionally one among many debtors from Voyager and reportedly owed $370 million. Nevertheless, inside weeks of 3AC’s downfall, Alameda moved from a borrower to a lender and provided a $500 million bailout in late June.

SBF took to Twitter to present insights on the bailout deal that finally turned the level of battle for Voyager. The troubled lender’s authorized group claimed that the CEO was attempting to create leverage for the commerce.

1) Voyager misplaced buyer belongings, nevertheless it nonetheless has the bulk left.

Why have not these been returned to prospects but?

Unhappy info from a chapter course of.

— SBF (@SBF_FTX) July 25, 2022

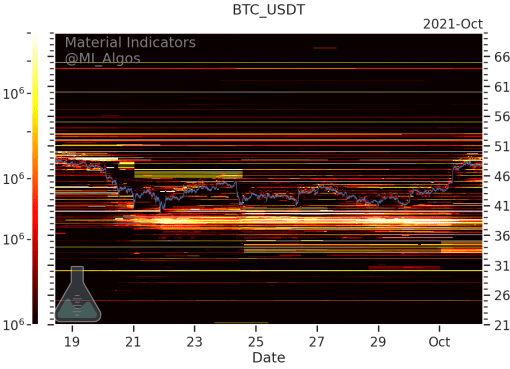

Authorized paperwork and monetary papers level towards the ties between the 2 corporations as early as September 2021. The identical paperwork additionally point out that Alameda borrowed rather more initially than the present quantity of $370M. Voyager’s monetary books point out that it lent out $1.6 billion in crypto loans to an entity based mostly within the British Virgin Islands, the identical place the place Alameda is registered.

Associated: Voyager cannot assure all prospects will obtain their crypto underneath proposed restoration plan

The authorized paperwork that confirm Voyager’s mortgage to 3AC additionally present a “Counterparty A” registered within the British Virgin Islands, owing them $376.784 million. In its chapter presentation, Voyager has proven Alameda owes them $377 million.

Alameda was additionally the largest stakeholder in Voyager, with an 11.56% stake within the firm acquired by two investments for a mixed complete of $110 million. When it accomplished the $500 million bailout, its funding was value $17 million. Earlier this yr, Alameda surrendered 4.5 million shares to keep away from reporting necessities, bringing its fairness right down to 9.49%.

Voyager CEO Stephen Ehrlich mentioned that after the chapter courtroom proceedings, many crypto holders on the platform can be probably eligible to get again a few of their belongings together with widespread shares within the reorganized Voyager, Voyager tokens, and proceeds from the now-defunct mortgage to 3AC.

As a part of this course of, the proposed Plan of Reorganization would resume account entry and return worth to prospects. Underneath this Plan, which is topic to alter given ongoing discussions with different events, and requires Courtroom approval:

— Stephen Ehrlich (@Ehrls15) July 6, 2022

The crypto contagion started with the now-defunct Terra stablecoin referred to as TerraUSD (UST), which finally led to the downfall of the $40 billion ecosystem. Many crypto hedge funds and lending corporations uncovered to Terra misplaced hundreds of thousands of {dollars}, which later led to the insolvency of 3AC, adopted by the downfall of crypto leaders resembling Celsius, BlockFi, Hodlnaut and Voyager.